how to lower property taxes in pa

Property Tax Reduction Allocations 2022-2023 Fiscal Year. The Center Square When it comes to property taxes Pennsylvania falls within the top third of states with the highest rates in the country.

Enjoy A Luxury Home At The Charming Hatboro Station Community In Hatboro Pa Luxury Homes Home Builders Home

The Taxpayer Relief Act provides for property tax reduction allocations to be distributed.

. The State of Pennsylvania has a high average effective property tax rate of 150. Property taxes are a crucial source of funds for Lower Paxton Township and other local public districts. The appeals board reduces that value to 150000.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Make sure youre present during the in-person. This places it among the top fifteen US.

Property Taxes in Pennsylvania. Up to 25 cash back The local tax rate is 10 for every 1000 of taxable value. Your local tax collectors office sends you your property tax bill which is based on this assessment.

WalletHub analyzed all 50 states and the District of Columbia using US. Home renovations may increase your homes market value which will boost your tax bill. 135 of home value.

Ad Property Taxes Info. Pennsylvania will continue its broad-based property tax relief in 2022-23 based on Special Session Act 1 of 2006. Northampton County PA Tax Assessment Property Search Explained.

PA Property Tax Assessment From A to Z. The Taxpayer Relief Act Act 1 of Special Session 1 of 2006 was signed into law on June 27 2006. Ad Reduce property taxes 4 residential retail businesses - profitable side business hustle.

WHTM New legislation proposed in Pennsylvania would eliminate school property taxes and establish a. Reduce property taxes for yourself or residential commercial businesses for commissions. Reduce property taxes for yourself or residential commercial businesses for commissions.

If you live in Pennsylvania you can count on property tax exemptions for veterans as a way to lower your property taxes. Find All The Assessment Information You Need Here. In order to come up with your tax bill your tax office multiplies the tax rate by.

Unsure Of The Value Of Your Property. So they appeal the 200000 taxable value. Consensus exists that eliminating Pennsylvanias property taxes remains possible albeit complex and not without trade-offsThe Independent Fiscal Office estimates districts collected 151.

After researching recent sales of comparable homes. To qualify you must. Property taxes in the Quaker State can do some serious damage to your wallet considering that the average property tax rate is 150.

Ad Reduce property taxes 4 residential retail businesses - profitable side business hustle. Put off home improvements after your assessment. PHILADELPHIA CBS-- The advent of casino gambling in Pennsylvania was supposed to help homeowners in the form of lower property tax bills.

Be a Commonwealth resident. Feb 24 2022 0406 PM EST. The tax rate in the Pittsburgh.

According to a report. The median property tax in Pennsylvania is 222300 per year for a home worth the median value of 16470000. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

Theyre a capital anchor for governmental services used to maintain cities schools. This means that their annual property tax is 4000. Tax amount varies by county.

Census data dividing the median real estate tax payment by the median home price in each state. Property owners in Pennsylvania should learn more about property taxes and ways to lower their tax bills. Special Session Act 1 of 2006 the Taxpayer Relief Act was signed on June 27 2006 and modified in June 2011 by Act 25 of 2011This law eases the financial burden of.

Up to 25 cash back If the tax rate is 1 Rocky and Adrianna will owe 2000 in property tax.

Pennsylvania Property Tax H R Block

Pennsylvania Department Of Revenue Parevenue Twitter

Toll Brothers At Liseter The Merion Collection Pa Luxury Homes Delaware Homes For Sale Home Builders

Pennsylvania Sales Tax Guide For Businesses

Pennsylvania Department Of Revenue Facebook

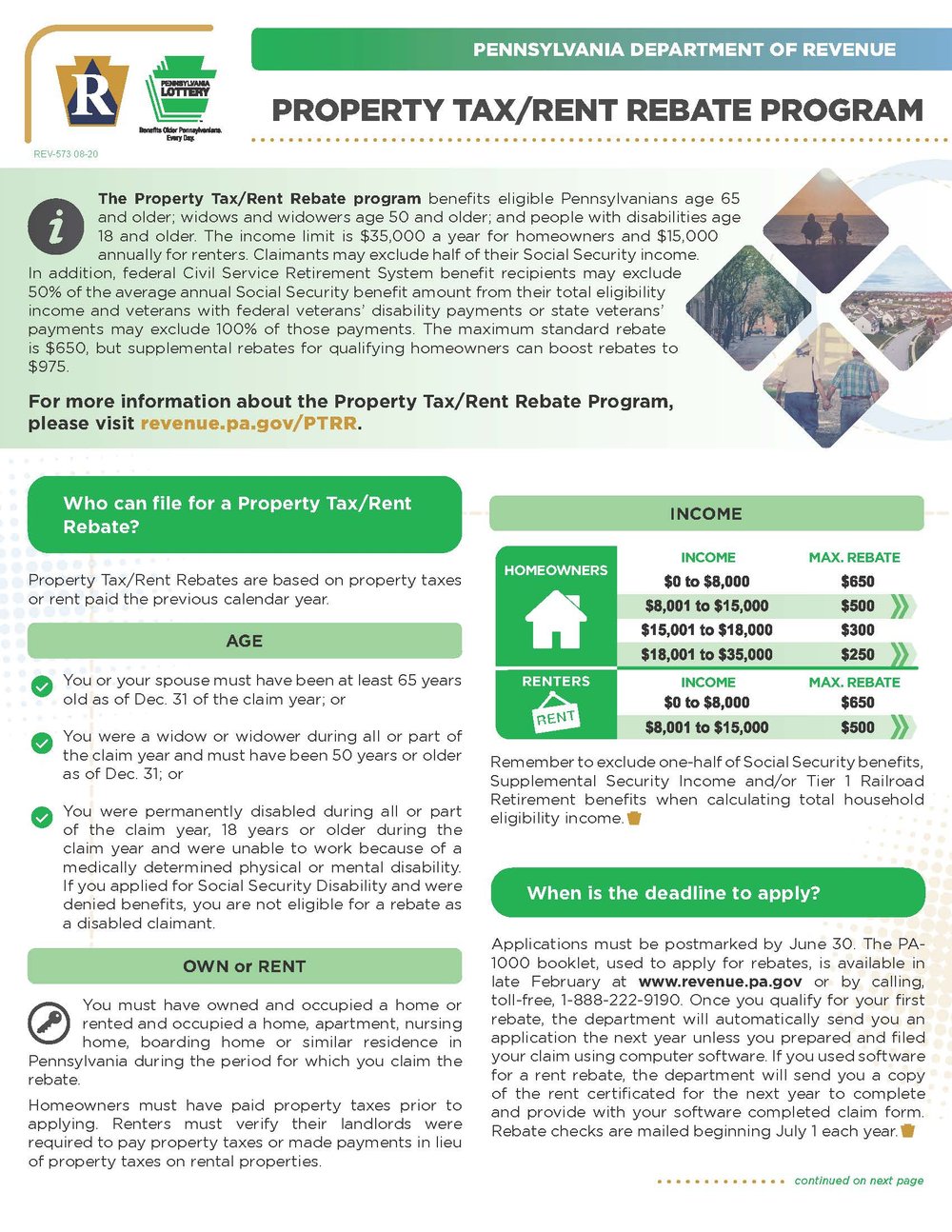

Pennsylvanians Can Now File Property Tax Rent Rebate Program Applications Online Pennsylvania Legal Aid Network

Pa Property Tax Rent Rebate Apply By 12 31 2022 New 1 Time Bonus Rebate Announced 8 2 2022 Legal Aid Of Southeastern Pennsylvania

Pa Property Tax Rent Rebate Apply By 12 31 2022 New 1 Time Bonus Rebate Announced 8 2 2022 Legal Aid Of Southeastern Pennsylvania

Sold 340 Debbie Lane In Ground Pool In Ground Pools House Styles Pool

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Which Pa Counties Have The Lowest Tax Burden The Numbers Racket Pennsylvania Capital Star

Pennsylvania Department Of Revenue Facebook

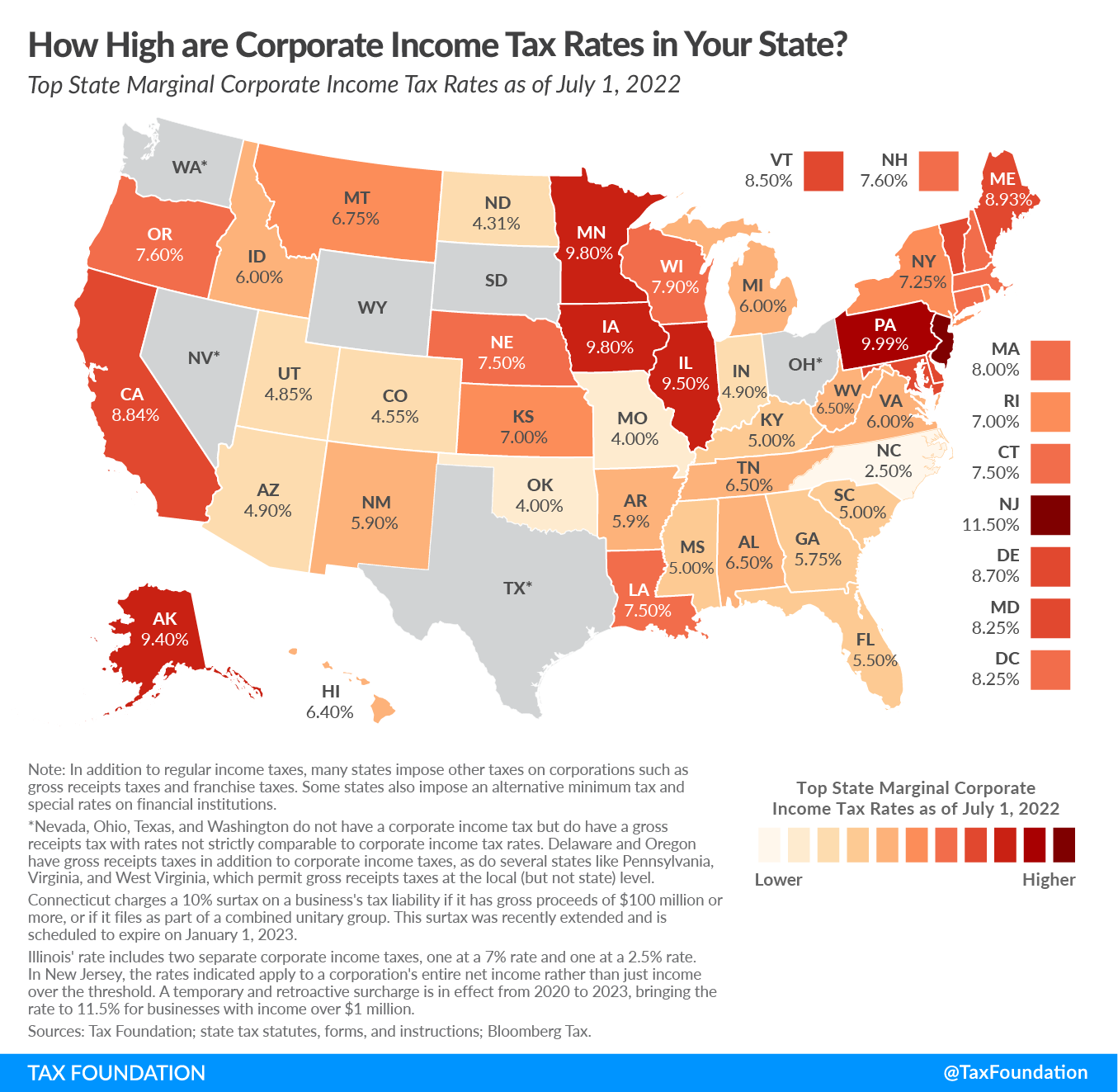

Pa Corporate Tax Cut Details Analysis Tax Foundation

Pa Property Tax Rent Rebate Apply By 12 31 2022 New 1 Time Bonus Rebate Announced 8 2 2022 Legal Aid Of Southeastern Pennsylvania

Pa Property Tax Rent Rebate Apply By 12 31 2022 New 1 Time Bonus Rebate Announced 8 2 2022 Legal Aid Of Southeastern Pennsylvania